Bangladesh’s apparel exports to the European Union recorded a sharp year-on-year decline in October 2025, despite strong cumulative growth over the first ten months of the year, according to Eurostat data released on 16 December.

Apparel exports to the EU in October fell by 19.67 per cent to €1.41 billion, down from €1.75 billion in the same month of 2024. Knitwear experienced the steepest monthly fall, dropping by 20.20 per cent, while exports of woven garments declined by 18.72 per cent.

However, cumulative apparel imports by the EU from Bangladesh during January–October 2025 reached €16.67 billion, marking solid growth of 9.45 per cent compared with €15.23 billion in the corresponding period of 2024.

Growth was recorded across both major categories, with knitwear rising by 10.66 per cent to €10.05 billion and woven products increasing by 7.67 per cent to €6.62 billion.

The year began with an exceptionally strong performance in January, when total RMG imports by the EU from Bangladesh surged by 61.01 per cent, or €724.48 million, to €1.91 billion.

This was driven by a 64.24 per cent increase in knitwear imports to €1.15 billion and a 56.41 per cent rise in woven garments to €766.01 million.

In February, the upward momentum continued as EU imports climbed by 26.64 per cent, or €349.49 million, to €1.66 billion. Knitwear imports grew by 29.55 per cent, while woven products rose by 23.01 per cent.

Bangladesh’s readymade garment exports to the EU peaked in March at €2.11 billion, representing an 18.54 per cent increase, or €330.39 million, over the same month of 2024.

Knitwear exports in the month rose by €194.01 million, or 19.98 per cent, while woven garments increased by €136.37 million, or 16.80 per cent.

Growth moderated in April, with EU apparel imports from Bangladesh rising by 5.94 per cent, or €104.17 million, to €1.86 billion.

A significant downturn followed in May, when Bangladesh’s RMG exports to the EU fell by 10.92 per cent, or €174.85 million, to €1.43 billion.

The decline was more pronounced in woven products, which dropped by 16.06 per cent, compared with a 7.25 per cent fall in knitwear.

June saw a strong recovery, as EU imports from Bangladesh increased by 20.42 per cent, or €228.88 million, largely supported by a 28.06 per cent surge in knitwear.

The positive trend continued in July, with EU imports growing by 6.87 per cent to €1.67 billion.

However, the EU market contracted again in August, when Bangladesh’s RMG exports declined by 7.73 per cent, or €125.30 million, across both categories.

September brought a temporary rebound, with total RMG exports to the EU rising by 15.66 per cent, or €240.60 million. During the month, woven products grew by 17.54 per cent, while knitwear increased by 14.55 per cent.

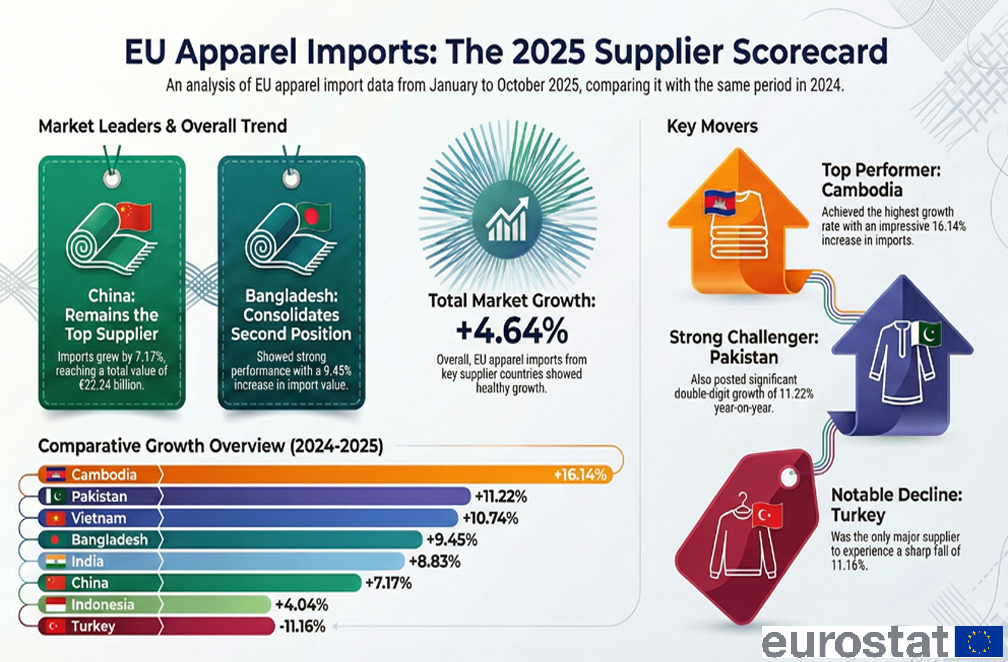

According to an analysis of Eurostat data, the EU apparel imports from major global sourcing countries rose from €72.5 billion in January-October 2024 to €75.9 billion in the same period of 2025, representing an overall increase of €3.37 billion or 4.64 per cent.

China remained the EU’s largest apparel supplier by a wide margin. Imports from China increased from €20.76 billion in January–October 2024 to €22.24 billion in January–October 2025, an absolute rise of €1.48 billion or 7.17 per cent.

Turkey stood out as the only major supplier to experience a sharp decline. EU apparel imports from Turkey fell from €7.95 billion in January–October 2024 to €7.06 billion in the same period of 2025, a drop of €886 million or 11.16 per cent.

India recorded steady growth in EU apparel imports, with total value rising from €3.68 billion to €4.01 billion. This represents an increase of €325 million or 8.83 per cent.

Vietnam continued to gain market share in the EU, as apparel imports increased from €3.28 billion in January-October 2024 to €3.63 billion in January–October 2025. The €352 million increase translated into growth of 10.74 per cent.

Pakistan also posted double-digit growth, with EU apparel imports rising from €2.89 billion to €3.21 billion, an increase of €324 million or 11.22 per cent.

Cambodia emerged as the fastest-growing supplier among the countries analysed. EU apparel imports from Cambodia jumped from €3.22 billion in January-October 2024 to €3.74 billion in the same period of 2025, an increase of €520 million or 16.14 per cent.

Indonesia recorded more modest but still positive growth. EU apparel imports increased from about €7.99 billion to €8.31 billion, an absolute rise of roughly €322 million or 4.04 per cent.