Bangladesh cemented its position as the European Union’s second-largest apparel supplier in the first half of 2025 with exports up 17.9 per cent to €10.29 billion, but its growth was eclipsed by China’s 22.3 per cent rise to €11.26 billion and Cambodia’s 30.4 per cent surge to €2.07 billion, signalling fiercer competition in the EU market.

According to Eurostat data released on August 18, EU apparel imports from Bangladesh rose to €10.29 billion in January–June 2025, up from €8.73 billion in the same period of 2024.

Knitwear was the main driver, rising by 21.1 per cent to €6.03 billion, while woven garments increased by 13.6 per cent to €4.26 billion.

When compared with other leading suppliers, Bangladesh’s growth was higher than the EU’s overall apparel import expansion of 12.3 per cent, showing its competitive strength.

EU apparel imports increased to €43.39 billion in the first half of 2025, up from €38.64 billion in the same period of 2024. Knitwear led the gains with a 14.7 per cent rise to €21.87 billion, while woven apparel grew 10 per cent to €21.51 billion.

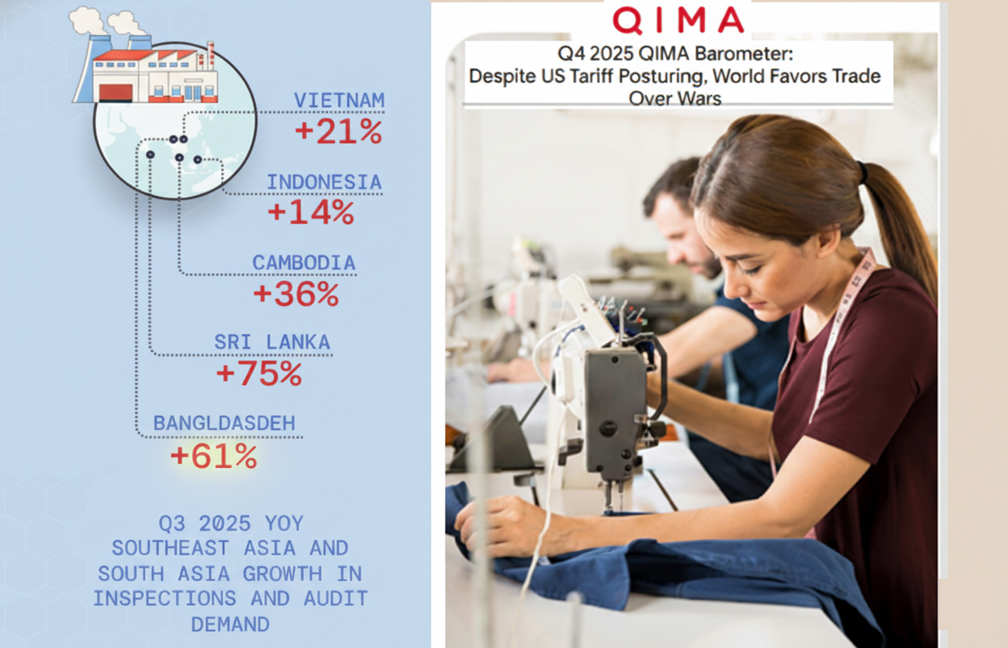

Other South Asian competitors also showed solid improvements but did not match Bangladesh’s overall momentum.

India increased its apparel exports to the EU by 15.4 per cent to €2.70 billion in January-June of 2025, with particularly strong growth in knitwear (22.4 per cent).

Pakistan grew by 16.6 per cent to €1.86 billion, recording balanced gains across knit and woven segments.

Vietnam maintained strong double-digit expansion, up 17.3 per cent to €2.02 billion, broadly in line with Bangladesh’s percentage increase.

With almost equal growth across knitwear and woven apparel, Vietnam continued to benefit from its trade agreements with the EU.

In contrast, Turkey, traditionally an important supplier due to its geographical proximity, was the only major exporter to see a decline.

EU apparel imports in the first half of 2025 from Turkey fell by 7 per cent to €4.27 billion, with both knit and woven categories in contraction.