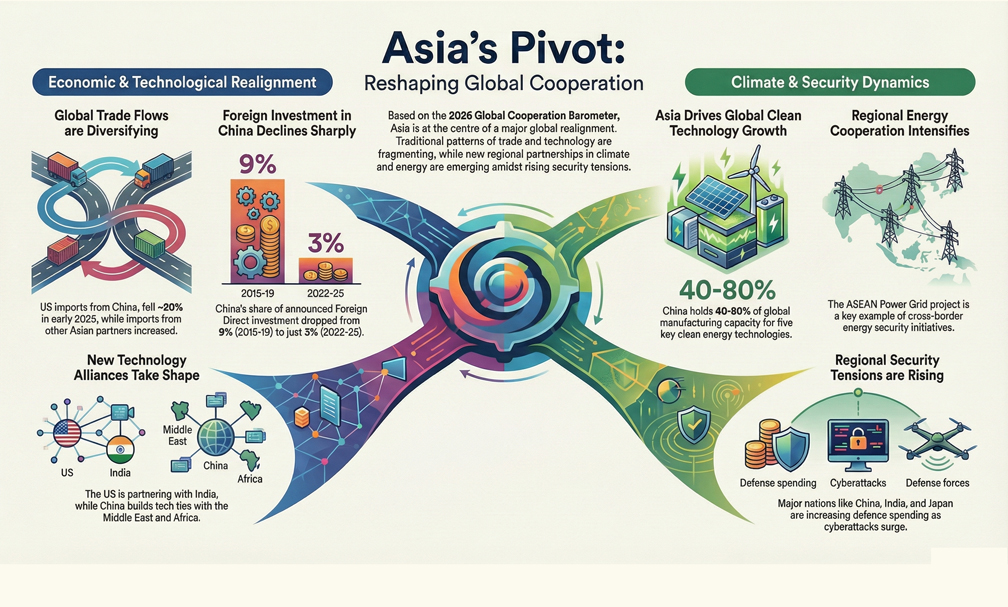

Asia and Southeast Asia are emerging as key drivers in the evolving landscape of global cooperation, where flexible ‘minilateral’ partnerships are gradually replacing traditional multilateral approaches, according to the World Economic Forum’s Global Cooperation Barometer 2026.

The report published on January 8, said that countries in the region are advancing clean technology, reshaping trade dynamics, and bolstering security frameworks at both domestic and regional levels.

In its third year, the Global Cooperation Barometer 2026, developed in collaboration with McKinsey & Company, uses 41 metrics to assess the level of cooperation worldwide across five pillars: trade and capital; innovation and technology; climate and natural capital; health and wellness; and peace and security.

According to the report, Southeast Asia has emerged as a focal point for innovative trade cooperation. The Digital Economy Framework Agreement (DEFA) among ASEAN nations was successfully concluded, streamlining digital trade and regional economic integration.

Long-standing negotiations, including the EU-Indonesia trade deal, were finalised in 2025 after more than a decade, reflecting the region’s growing capacity for pragmatic diplomacy.

Southeast Asian nations are also participating in plurilateral initiatives, such as the Future of Investment and Trade (FIT) Partnership launched in September 2025, which brings together 14 small and medium-sized economies to manage market access amid global trade barriers.

Asia is also at the forefront of the global energy transition. China accounted for two-thirds of new global solar, wind, and electric vehicle capacity by mid-2025, although concerns over over-concentration remain, with the country manufacturing 70-80 per cent of many clean technologies.

India added the second-largest amount of solar capacity worldwide in 2025, while Pakistan expanded energy access through affordable solar imports.

ASEAN nations are aligning decarbonisation with energy security objectives, aiming to balance environmental targets with stable domestic energy supplies.

In the sphere of defence and security, Asian countries are responding to declining global security metrics with strengthened capabilities and regional cooperation.

Major powers, including China, India, Japan, and Australia, increased their national defence spending significantly during 2024-2025.

Despite rising tensions, regional rivalries have largely been managed with restraint, preventing escalation into open conflict.

The Barometer described this as ‘patchwork resilience,’ where regional initiatives succeed even as UN-led global peacekeeping faces challenges.

The report said that China continued to exert global influence in technology and energy but faces increasing isolation in certain international flows.

Geopolitical tensions, especially with the United States, have restricted access to critical resources, advanced technologies, and intellectual property.

China’s share of global Foreign Direct Investment (FDI) fell from 9 per cent during 2015-2019 to just 3 per cent between 2022 and 2025.

Defence spending has risen sharply, reflecting concerns over regional and global security dynamics.

India has emerged as a significant contributor to global energy and health outcomes. The country added the second-most solar capacity globally in 2025 and recorded notable increases in defence spending alongside other major powers.

Australia and Japan have intensified their participation in minilateral security and trade arrangements to enhance resilience.

Australia finalised a bilateral framework with the United States in October 2025 for the mining and processing of critical minerals and rare earths, while both countries expanded defence budgets and maintained their role as education hubs, with international student flows rising by 8 per cent in 2024.

Southeast Asia’s cooperation extends to trade, technology, and energy. The DEFA agreement has promoted digital integration across ASEAN nations, while the EU-Indonesia trade deal and plurilateral initiatives like FIT have strengthened economic resilience amid rising global barriers.

The United States’ trade policies have influenced these regional shifts.

In China, technological restrictions and changes in investment patterns have contributed to a decline in FDI inflows.

A 100 per cent tariff on pharmaceutical imports announced in September 2025 challenged long-standing trade agreements but was temporarily paused for domestic manufacturing negotiations.

Southeast Asian nations, meanwhile, have leveraged these dynamics to finalise regional and bilateral deals, enhancing supply chain resilience.

This comprehensive report portrays Asia and Southeast Asia as shaping the future of global cooperation, blending innovation, trade, energy transition, and security to maintain influence in a rapidly shifting international order.