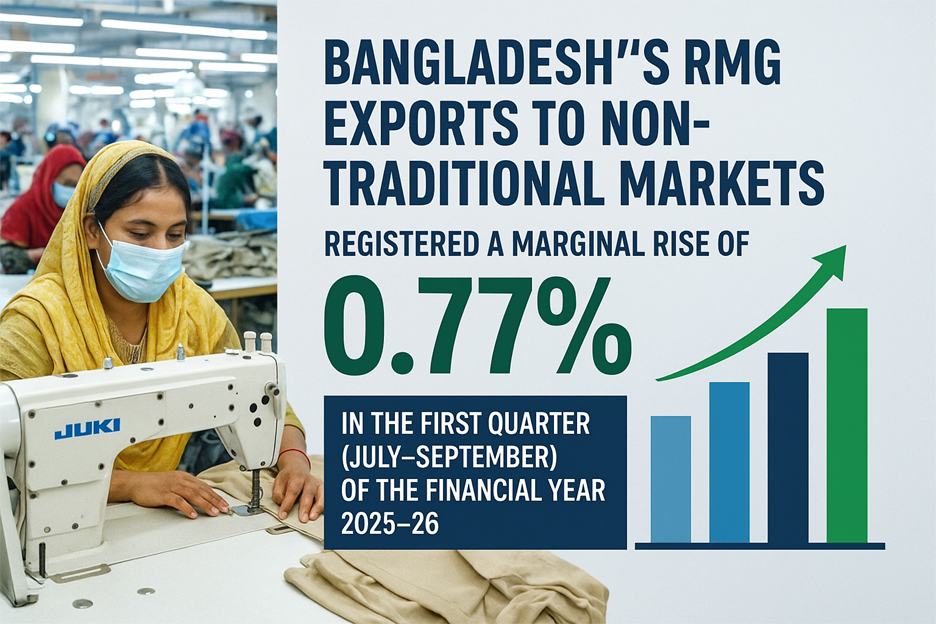

Bangladesh’s readymade garment (RMG) exports to non-traditional markets registered a marginal rise of 0.77 percent in the first quarter (July–September) of the financial year 2025–26, reflecting a slow but steady expansion beyond traditional destinations such as the European Union, the United States, and Canada.

The country’s total exports to non-traditional markets reached $1.66 billion during the three-month period, slightly up from $1.64 billion in the corresponding quarter of the previous fiscal year.

According to the Export Promotion Bureau data, woven garments performed better than knitwear during the first quarter of FY26.

Woven exports rose by 2.99 percent to $847.37 million, while knitwear exports fell by 1.45 percent to $808.91 million.

The positive growth in woven apparel helped offset the decline in the knit segment, resulting in a marginal overall increase in total exports to these emerging markets.

China emerged as the fastest-growing destination for Bangladeshi apparel, with total exports surging by 59.52 percent to $71.14 million.

The sharp rise was driven by an 85.88 percent jump in woven garment exports, while knitwear sales dipped slightly.

Other major markets showing strong growth included Saudi Arabia, Chile, Brazil, Japan, and South Africa, with exports rising by 34.38 percent, 14.37 percent, 9.66 percent, 10.56 percent, and 9.72 percent respectively.

Japan retained its position as the largest non-traditional export destination, importing apparel worth $334.91 million during July–September of FY26.

India ranked second with $216.59 million, followed by Australia with $206.94 million, South Korea with $111.15 million, and China with $71.14 million.

These five markets together accounted for nearly 57 percent of Bangladesh’s total exports to non-traditional destinations.

Despite the overall positive trend, knitwear exports experienced notable declines in several key markets.

Exports to South Korea dropped by 32.44 percent, Turkey by 28.65 percent, and Mexico by 27.32 percent, while Australia also saw a fall of 7 percent.

RMG exports to the United States, the single largest destination for Bangladesh, increased by 8.60 per cent to $2.01 billion in July-September period of the FY26 from $1.85 billion in the same period of FY25.

Shipment of apparel to Germany fell by 3.17 per cent to $1.12 billion in July-September period of the FY26 from $1.16 billion in the same period of FY25.

RMG exports to the United Kingdom increased by 6.74 per cent to $1.22 billion in the first quarter of the FY26 from $1.14 billion in the same period of FY25.

The country’s total exports of RMG products rose by 4.79 per cent, reaching $9.97 billion in the first quarter of FY2025–26 compared with $9.51 billion in the same quarter of FY2024–25.

Within the sector, knitwear exports increased by 4.31 per cent to $5.58 billion, while woven garments rose by 5.41 per cent to $4.39 billion.