The Ministry of Commerce in Bangladesh asked the National Board of Revenue (NBR) to withdraw bonded warehouse facilities for the import of cotton yarn ranging from 10 to 30 counts, citing mounting risks to domestic industry, investment and future export competitiveness.

In a letter to the revenue authority, the ministry on January 12 said the proposed measure would apply to cotton yarn imported under HS headings 52.05, 52.06 and 52.07.

It also recommended that customs houses be instructed to ensure the specific yarn count is clearly stated in the commercial description of all import bills of entry, in order to prevent misuse of the facility.

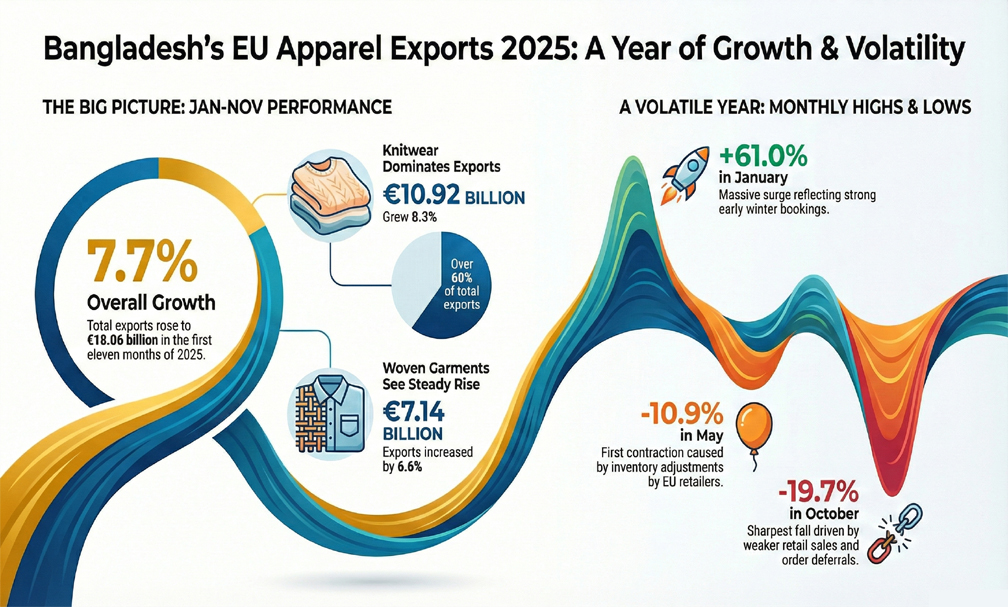

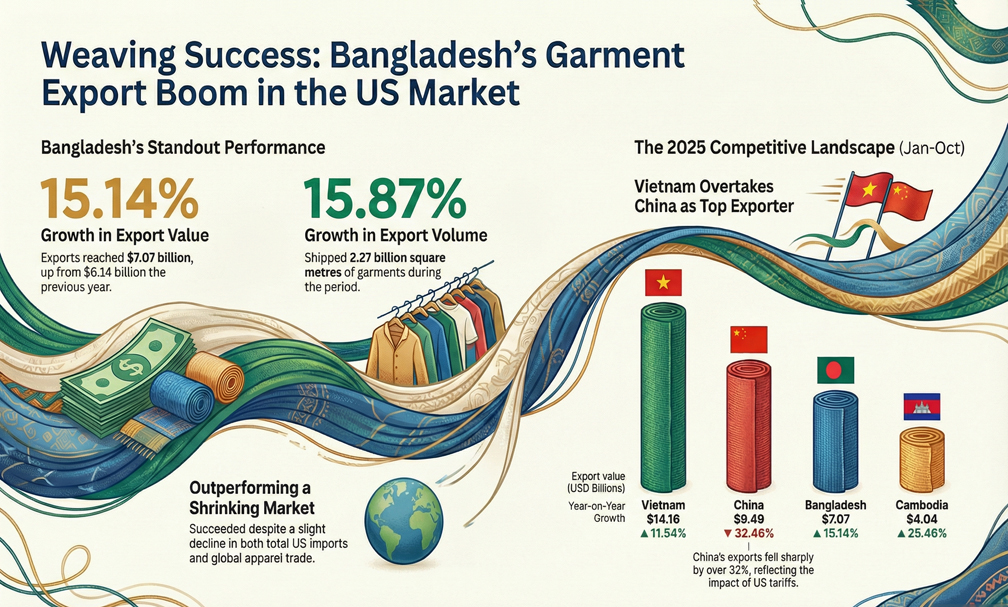

The textile and garment sector remained the backbone of Bangladesh’s economy, accounting for about 84 per cent of total export earnings. Knitwear alone contributes roughly 55 per cent.

While duty-free imports of raw materials under the bond system have been in place since the 1980s to support export growth, the ministry said the industry structure has changed fundamentally.

Over the past decades, local entrepreneurs have invested an estimated Tk 3 lakh crore in backward linkage industries, building sufficient capacity to meet the country’s entire demand for cotton and blended yarn.

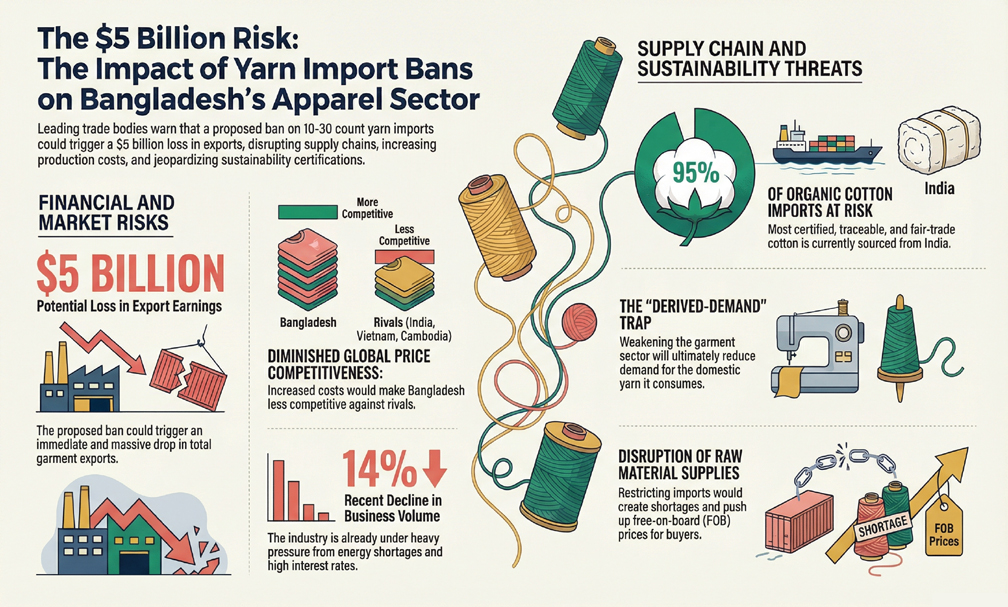

Despite this, domestic spinning mills are operating at around 60 per cent of installed capacity, largely because they cannot compete with heavily subsidised imports from neighbouring countries.

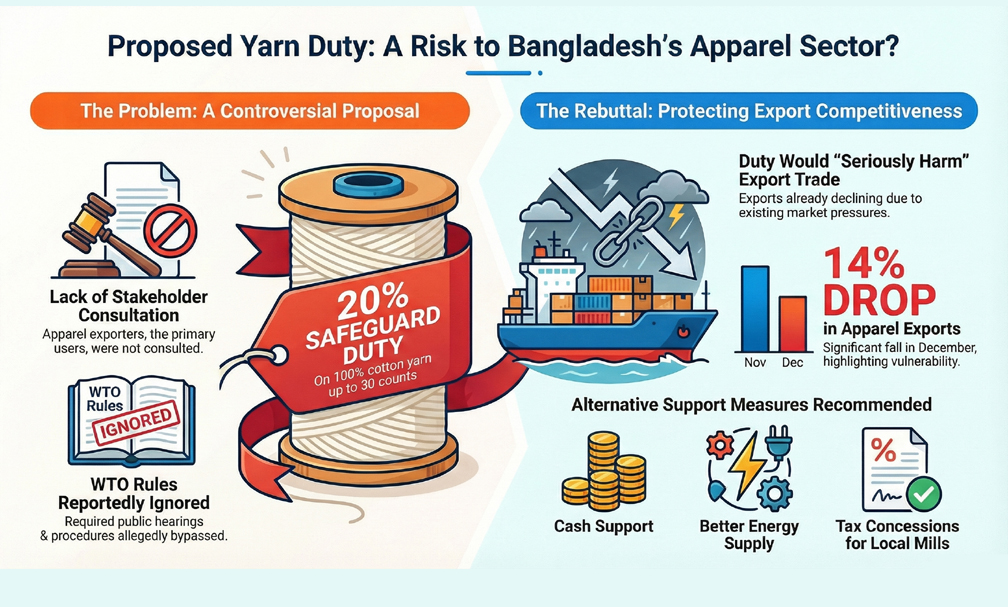

Data cited by the ministry showed that yarn imports under bond facilities surged sharply in recent years.

Between the financial year 2022–23 and 2024–25, total imports of cotton yarn under the three HS headings rose by about 99 per cent in volume.

The bulk of imports fell under HS 52.05, where shipments from a neighbouring country more than doubled over the period, even as the average import price per kilogram declined.

According to the ministry, this trend is driven by aggressive industrial support policies abroad, including capital subsidies, preferential interest rates, power subsidies, tax exemptions and other incentives.

These measures allow foreign producers to export yarn to Bangladesh at prices estimated to be 30 to 38 US cents below production cost.

By contrast, local producers, despite improving efficiency and lowering costs, have been unable to match such prices.

The impact on the domestic sector has been severe. Around 50 large yarn-producing units have already shut down, and officials warned that further closures are likely if the current import pattern continues.

Increased reliance on imported yarn, the ministry said, would raise lead times for garment exporters, reduce domestic value addition and put additional pressure on foreign exchange reserves.

The issue also carries long-term implications as Bangladesh prepares to graduate from Least Developed Country (LDC) status in November 2026.

After graduation, duty-free access to major markets such as the European Union would depend on meeting stricter rules of origin, typically requiring 40 to 50 per cent local value addition.

In many cases, ‘double stage transformation’— producing garments from locally made yarn or fabric — will be mandatory to qualify for tariff preferences, including GSP+.

The ministry said that similar value addition thresholds already apply in markets such as Australia and Canada, and that double stage transformation has featured prominently in recent and ongoing trade negotiations, including proposed free trade and partnership agreements.

Officials warned that growing dependence on imported yarn, particularly in the knitwear segment, could undermine Bangladesh’s ability to secure duty-free access in the post-LDC period.

Against this backdrop, the Bangladesh Trade and Tariff Commission has recommended keeping 10 to 30 count cotton yarn outside the bond facility as a short-term measure.

The commerce ministry said it supports this recommendation in order to protect local production, employment and investment.