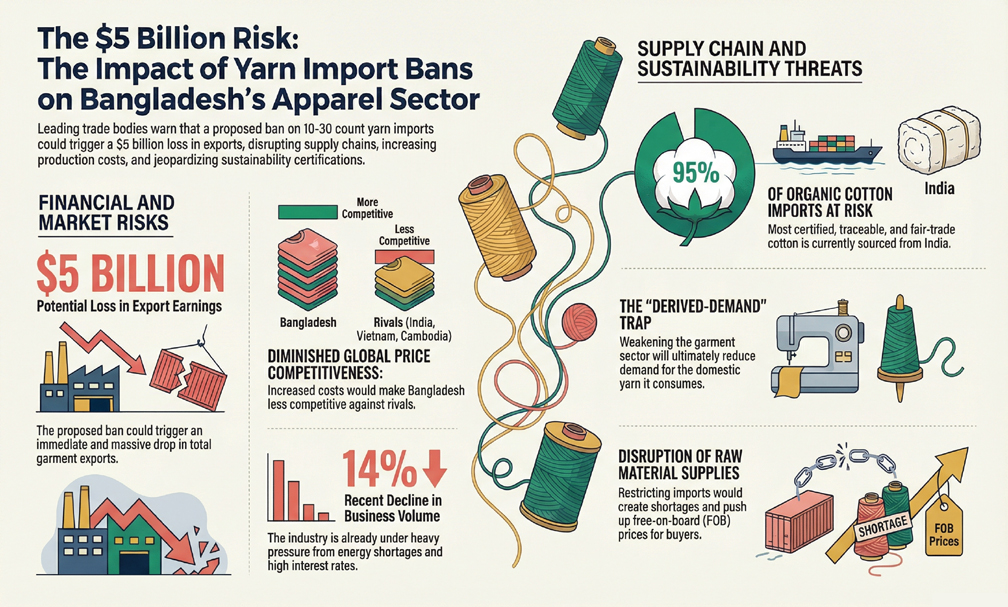

Bangladesh’s export-oriented apparel industry could suffer an immediate loss of around $5 billion in export earnings if the government proceeds with a proposed ban on the import of 10-30 count cotton yarn under the bonded warehouse facility, according to a joint letter issued by the country’s leading garment trade bodies.

In a letter dated January 18 and addressed to the Ministry of Finance, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) expressed deep concern over the proposal, warning that it would have severe and multi-dimensional consequences for exports, employment, foreign exchange earnings and overall economic stability.

The associations urged the government to reject the measure, arguing that it would damage, rather than protect, the domestic textile and garment ecosystem.

The readymade garment sector accounts for more than 80 per cent of Bangladesh’s total export earnings and supports the livelihoods of millions of workers directly and indirectly.

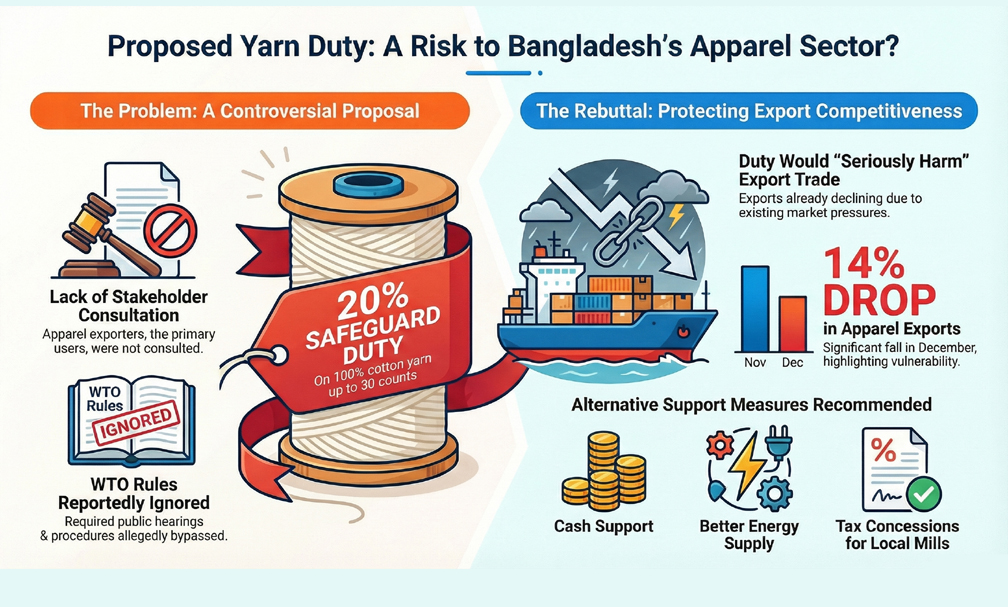

For decades, the industry has relied on the WTO-compliant bonded warehouse system to import raw materials, including cotton yarn, which industry leaders described as a fundamental pillar of Bangladesh’s global competitiveness.

Any disruption to this system, they warned, would undermine the sector’s ability to compete in an increasingly buyer-driven international market.

According to the joint letter, imposing a ban on the import of 10-30 count cotton yarn would not solve the challenges currently faced by the domestic spinning sector.

Instead, it would create serious disruptions in raw material supplies for export-oriented garment factories, increase production costs and push up free-on-board prices.

In the current global context, where international buyers exert strong price pressure, Bangladesh would be unable to pass on these additional costs, putting export orders at risk.

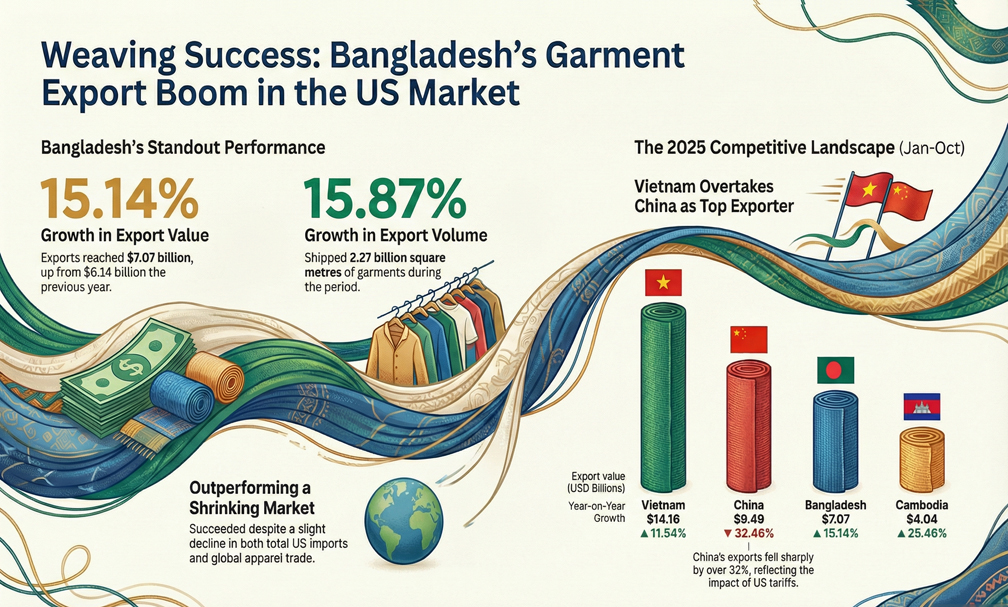

The trade bodies cautioned that global buyers constantly compare Bangladesh with competing sourcing countries such as India, Vietnam and Cambodia on the basis of price, reliability and supply chain stability.

Any uncertainty over raw material availability could prompt buyers to shift orders to alternative suppliers, leading to a decline in export earnings and a reduction in foreign exchange inflows.

They also warned that a direct consequence of a yarn import ban would be an increase in grey fabric imports.

Rather than compelling buyers to use locally produced yarn, international brands could instruct factories to import grey fabric from countries where yarn supplies are readily available and policy restrictions are minimal. This shift would significantly reduce demand for domestically produced fabric.

Such a development, the letter noted, would severely damage the local knitting industry.

Lower capacity utilisation would push up production costs, particularly affecting small and medium-sized knitting mills, many of which could face closure.

As a result, employment would decline and domestic value addition would fall sharply, weakening backward linkages within the textile sector.

The associations further argued that the proposed ban would ultimately benefit India rather than Bangladesh.

India is a major supplier of both cotton yarn and grey fabric. Restricting yarn imports would increase the price-setting power of Indian suppliers, effectively turning Bangladesh into a captive buyer forced to pay higher prices for imported fabric.

BGMEA and BKMEA also stressed that the spinning and knitting sectors are derived-demand industries, with an estimated 85 to 90 per cent of locally produced yarn consumed by the export-oriented garment sector.

If garment exports decline due to supply disruptions and higher costs, demand for domestic yarn would also fall.

Protecting the spinning sector by weakening garment exports, they warned, is not sustainable in the long term.

Another major concern highlighted in the letter relates to sustainable and certified cotton.

Around 95 per cent of Bangladesh’s organic and certified cotton, including organic, regenagri, traceable BCI and fair-trade cotton, is imported from India.

Any trade disruption linked to a yarn ban could affect access to these materials, prompting international buyers focused on sustainability compliance to reconsider sourcing from Bangladesh.

The associations said that the garment sector is already under pressure from declining global demand, intense price competition, high interest rates, energy shortages and geopolitical uncertainty.

They noted that business volumes have already fallen sharply, with an overall decline of about 14 per cent in recent months.

Introducing a raw material import ban at this stage, they warned, could trigger an immediate loss of export business worth approximately $5 billion.

Instead of imposing trade restrictions, BGMEA and BKMEA called for supportive policies, including uninterrupted energy supply, rational interest rates, incentives and skills development programmes in line with WTO rules.