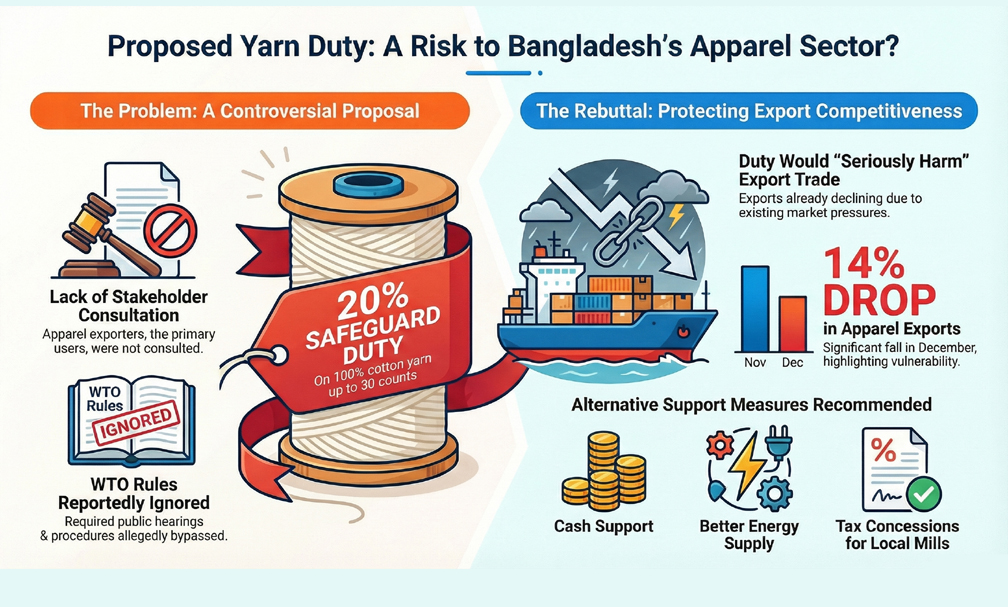

The country’s apparel makers have strongly opposed a proposal to impose a 20 per cent safeguard duty on imports of 100 per cent cotton yarn up to 30 counts, warning of serious risks to export competitiveness.

They alleged that the Bangladesh Trade and Tariff Commission proposed the duty after consulting only the Bangladesh Textile Mills Association (BTMA), without holding any discussion with apparel exporters, despite them being the primary users of imported yarn for export-oriented garment production.

In separate letters sent to the BTTC on January 6, Bangladesh Garment Manufacturers and Exporters Association (BGMEA), Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) formally protested the proposal and expressed deep concern, citing procedural flaws and potential harm to the country’s already struggling apparel export sector.

The two associations further claimed that the proposal ignored required procedures under World Trade Organization rules, including consultations with yarn-exporting countries, submission of formal complaints, organisation of public hearings, and prior notification to the WTO.

Sources said the BTTC held a meeting with the BTMA on January 5, where BGMEA and BKMEA were not invited, prompting dissatisfaction among garment exporters.

Following protests from the two trade bodies, the BTTC is scheduled to hold a meeting with BGMEA and BKMEA on January 8, to discuss the proposed safeguard duty, the sources said.

In his letter, BKMEA president Mohammad Hatem said the proposed duty rate was determined without consultation with key stakeholders, noting that BKMEA and BGMEA are the largest importers of cotton yarn for export production.

Citing Articles 3 and 4 of the WTO Safeguard Agreement, he said any safeguard measure requires proper investigation, stakeholder consultation, and specific supporting evidence before implementation.

He also argued that the proposed 20 per cent duty appeared to be based on anticipation rather than evidence, making it inconsistent with WTO rules governing safeguard measures.

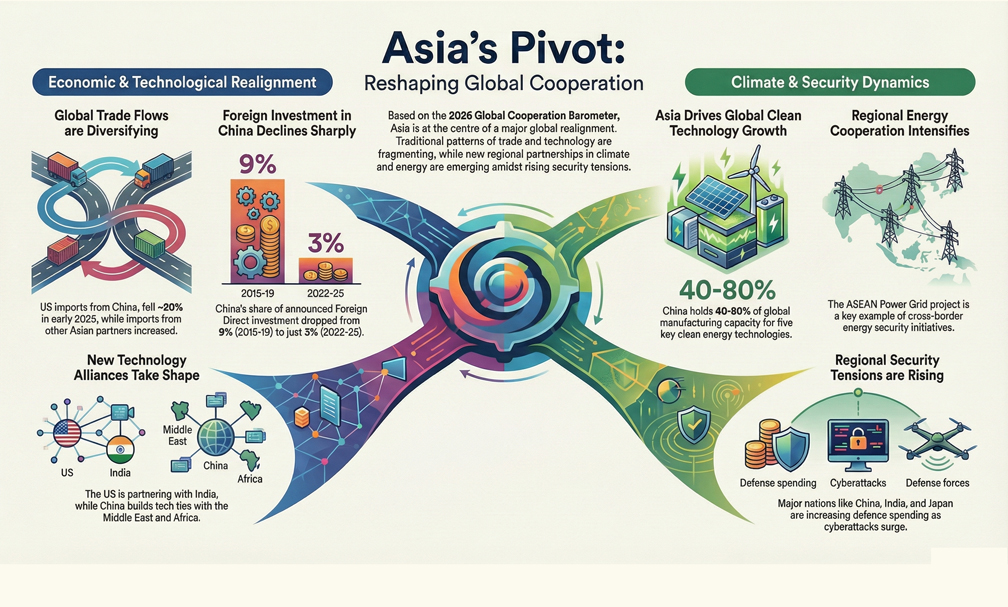

Hatem said that BKMEA and BGMEA members mainly import yarn from China, India, Vietnam, and other countries under bonded warehouse licences, adding that such yarn is used solely for exports and not sold locally.

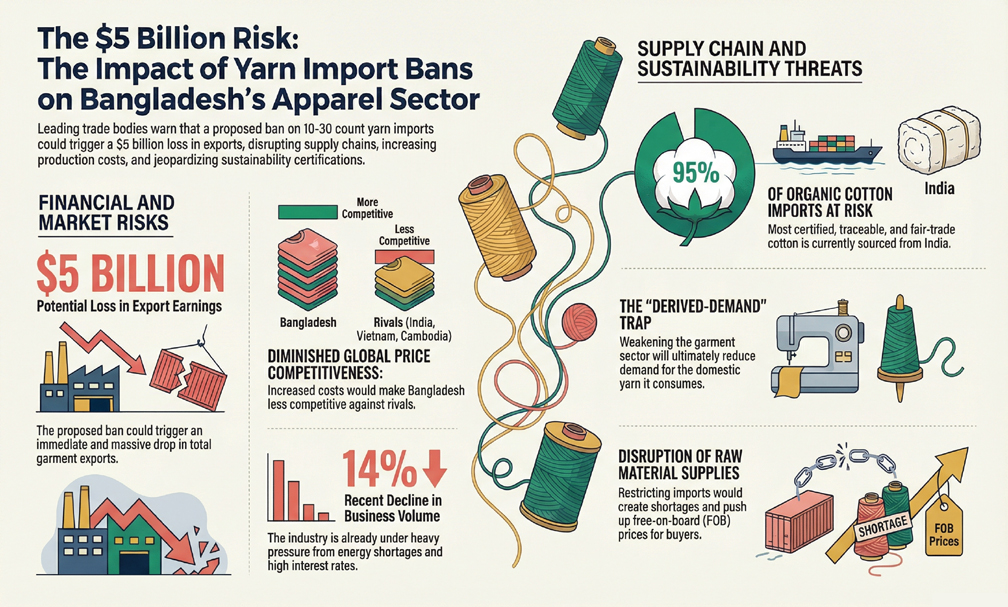

While admitting that these imports may cause comparative cost pressures for local spinners, he warned that using this factor to justify safeguard duties would severely damage export trade and overall industry performance.

In a separate letter, BGMEA acting president Salim Rahman said export-oriented garment factories source carded yarn from both local and foreign suppliers based on buyer price requirements and product specifications.

He warned that imposing safeguard duties on such imports would seriously harm export trade, while imposing duties on goods imported duty-free under bond facilities would conflict with existing laws and create new legal complications.

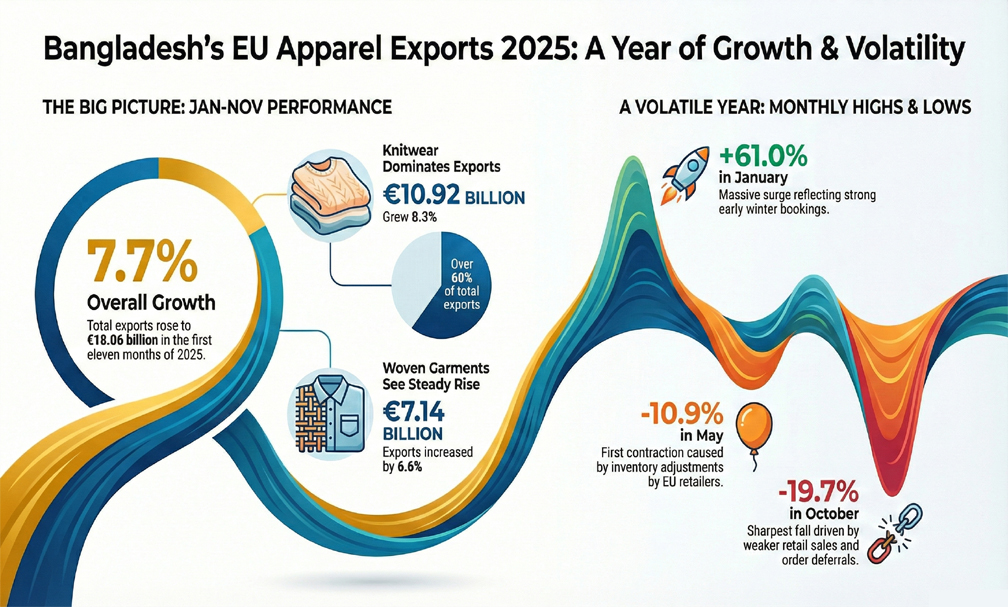

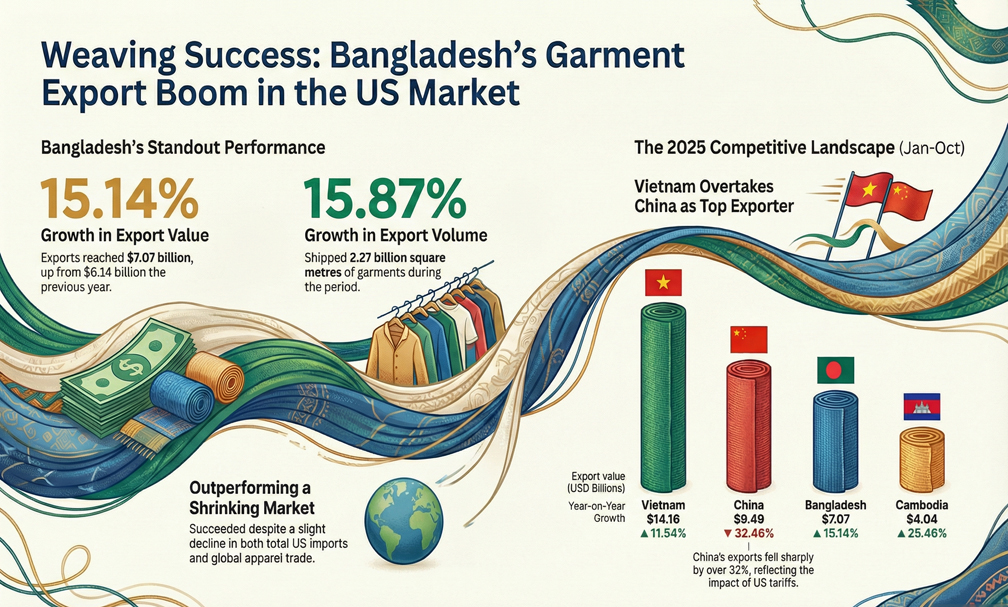

Both leaders said Bangladesh’s garment exports have been declining for several months due to a combination of internal challenges and external market pressures.

They noted that apparel export earnings fell by more than 14 per cent in December, describing the proposed 20 per cent safeguard duty on imported cotton yarn as a dangerous decision for the sector.

To protect the local textile industry, they recommended alternatives such as targeted cash support at rational rates, improved gas supply, reasonable energy pricing, tax concessions for export-oriented yarn producers, and easier access to low-interest loans.

The BGMEA and BKMEA finally urged the authorities not to impose any safeguard duty on imported cotton yarn, stressing the need to protect exports while addressing industry challenges through balanced policy measures.