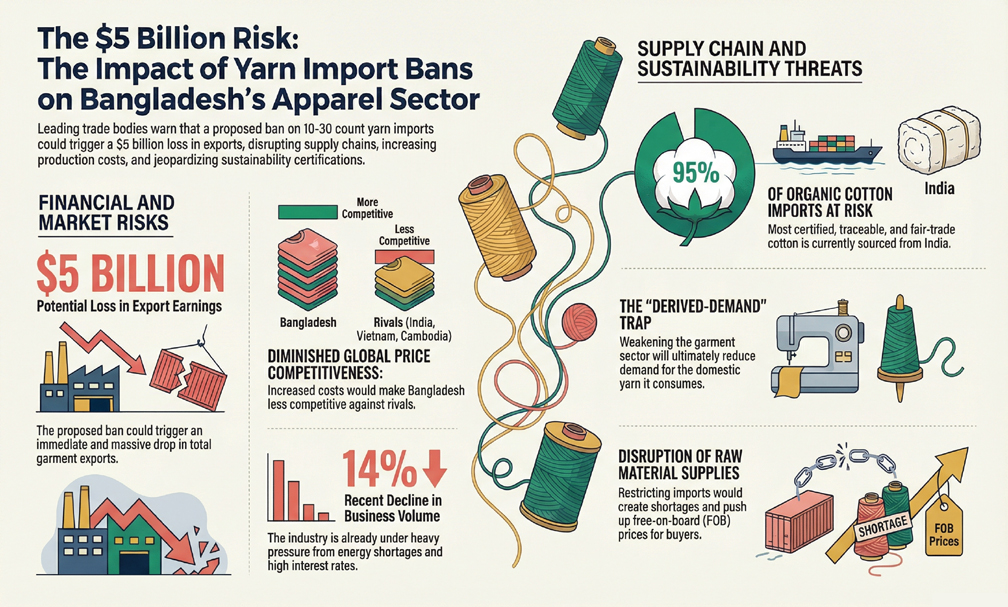

Bangladesh’s apparel makers and textile mill owners are at loggerheads over the government’s plan to withdraw bonded warehouse facilities for the import of 10 to 30 counts of yarn, raising concerns about potential disruption in the country’s largest export sector.

Leaders of the readymade garment sector on Monday criticised the commerce ministry for a ‘unilateral’ recommendation to remove the bond facility, warning that implementation of such a move could push the apparel industry into a serious crisis.

The Bangladesh Textile Mills Association (BTMA) hit back, saying the ministry had consulted all stakeholders and calling the RMG leaders’ claims inaccurate.

The bond facility allows export-oriented industries to import raw materials duty-free, provided the finished goods are exported.

Speaking at a press conference organised jointly by the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) at a Dhaka hotel, industry representatives outlined the possible consequences if the National Board of Revenue (NBR) implements the ministry’s proposal.

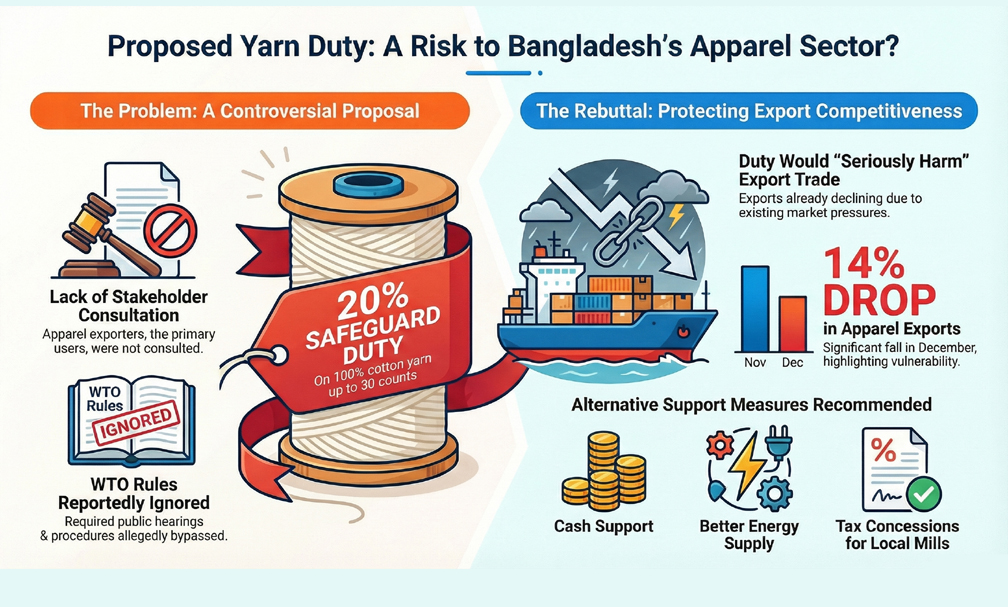

BGMEA acting president Selim Rahman emphasised that garment exporters are the primary buyers of locally produced yarn, yet their interests were disregarded in making such a sensitive policy decision.

‘During discussions with the Bangladesh Trade and Tariff Commission (BTTC), our views were sidelined. The proposal risks violating Articles 3 and 4 of the World Trade Organization’s Safeguards Agreement,’ he said.

Selim said that to strengthen domestic textile production, the government should focus on capacity expansion, efficiency improvements, modernisation, direct incentives, and uninterrupted energy supply rather than imposing duties on imported yarn.

He cautioned that higher yarn costs could lead buyers to reduce orders, threatening both RMG exports and local textile production.

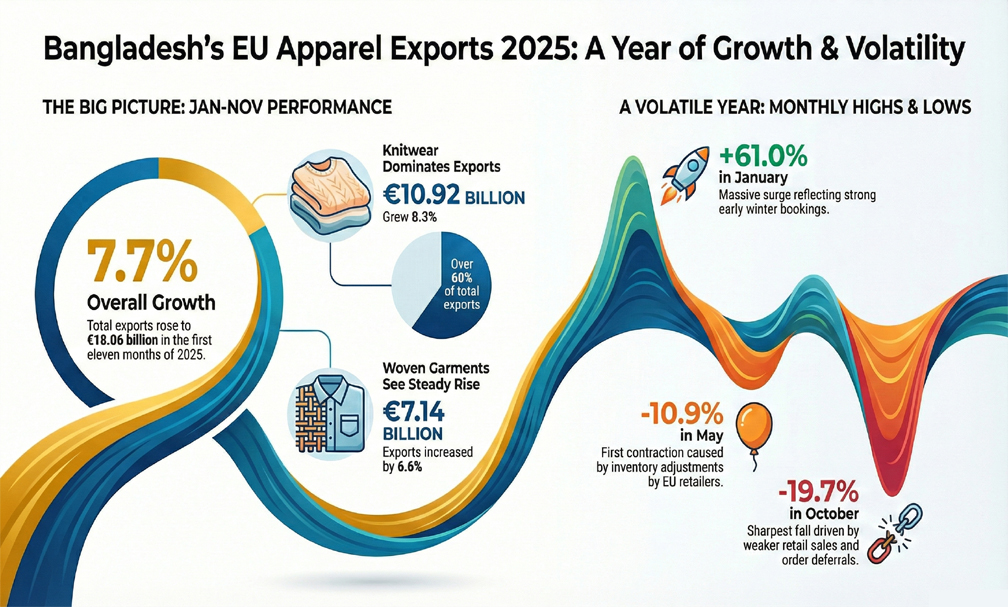

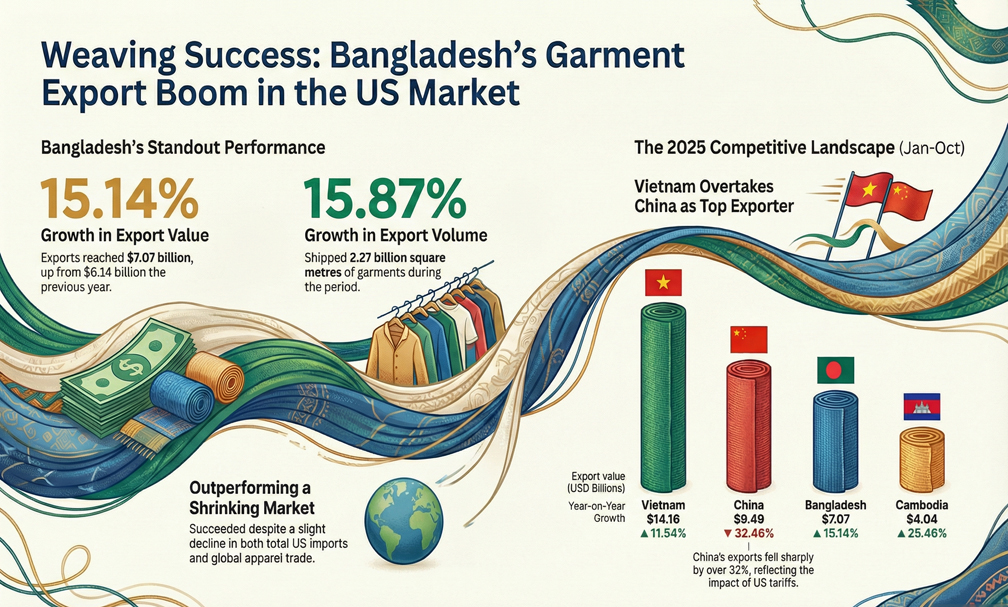

Export figures already show a decline, with RMG exports falling by 2.63 per cent during July–December FY26 and dropping sharply by 14.23 per cent in December alone.

BKMEA president Mohammad Hatem questioned why the commerce ministry and BTTC had not examined the underlying reasons for rising yarn imports from India, noting that reduced cash incentives for local textile millers had contributed to the trend.

‘If yarn imports are restricted, fabric imports from China, which remain cheaper than locally produced textiles, may increase,’ he warned.

Hatem also alleged that the Indian government provides various incentives in ways that circumvent WTO rules, while Bangladesh continues to reduce incentives for exporters.

BKMEA executive president Fazlee Shamim Ehsan pointed out that India sells yarn at prices below production costs, suggesting that anti-dumping measures under WTO regulations could be applied instead of imposing restrictions on imports from global sources.

He described attempts to limit imports as a move towards creating a monopoly that does not comply with fair business practices.

BTMA president Showkat Aziz Russell responded to the press conference, disputing some of the claims made by RMG representatives.

He clarified that the commerce ministry had consulted with stakeholders from BTMA, BGMEA, and BKMEA before applying to the BTTC.

‘After careful verification of the data, the ministry recommended that only yarn of counts 10 to 30 (HS Codes 5205, 5206, 5207) be excluded from bond facility benefits. No new duties or safeguard measures were proposed,’ Russell said.

He further stated that duty-free imports under the bond facility have largely benefited foreign buyers rather than domestic RMG manufacturers.

Local spinning mills, despite substantial investment, face challenges competing with subsidised yarn from neighbouring countries.

Russell maintained that multiple formal and informal meetings had been held with industry stakeholders and government officials before the recommendation, and both parties had expressed agreement with the proposals.

At the press conference, RMG sector leaders stressed the importance of policy measures that support local textile mills without harming the RMG sector.

Ehsan argued that restricting imports could damage Bangladesh’s competitiveness in global markets, as export-oriented industries worldwide enjoy duty-free access to raw materials.

He also highlighted the previous government ban on yarn imports through land ports, noting that its impact on local mills was limited.

Apparel makers urged the government to conduct comprehensive consultations with all stakeholders and engage economists and researchers in assessing the policy’s impact.

They emphasised that any move to withdraw bond facilities without adequate dialogue and support measures could undermine Bangladesh’s position as one of the world’s leading apparel exporters.

Last week, the Commerce Ministry urged the NBR to withdraw bonded warehouse facilities for importing 10 to 30 counts of yarn to protect domestic textile mills, following a request from the BTMA and a recommendation from the BTTC.

Meanwhile, the BGMEA and BKMEA sent separate letters to the advisers of the Commerce Ministry, the Finance Ministry, and the NBR chairman to state their opposition to the government’s proposed withdrawal of the bond facility.