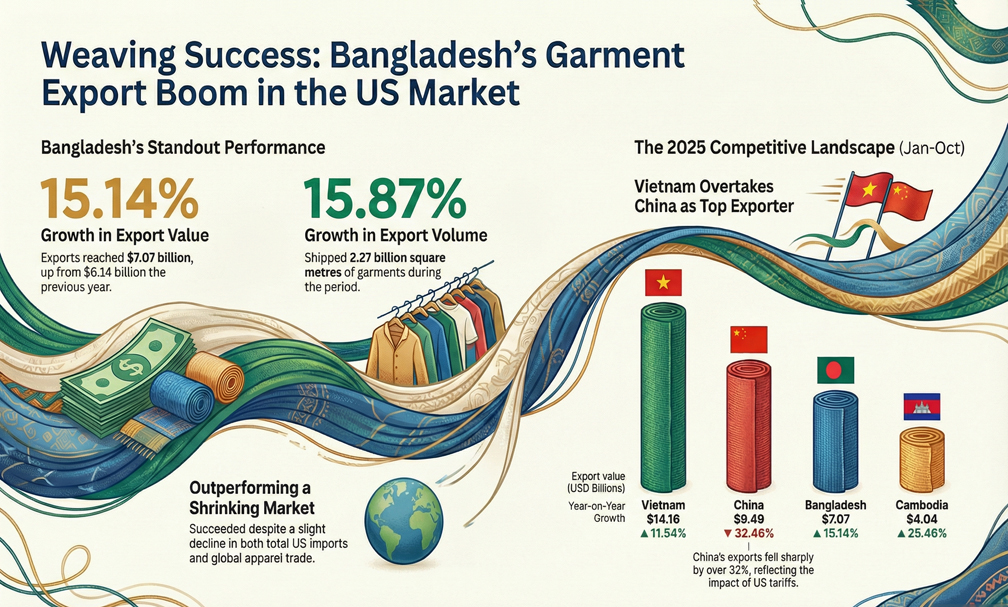

Bangladesh’s readymade garment (RMG) exports to the United States, its largest single market, rose by 15.14 per cent in the first ten months of 2025.

According to official US data, exports increased both in value and volume between January and October this year.

During this period, Bangladesh shipped garments worth $7.07 billion, up from $6.14 billion in the same period of 2024, according to figures released on January 8 by OTEXA, an affiliate of the US Department of Commerce.

The country’s growth rate during this period outpaced most of its major competitors, although Cambodia also recorded significant gains.

While Vietnam maintained its position as the leading exporter to the US, pushing China into second place, Bangladesh remained ahead of other rivals in export growth.

Globally, apparel trade shrank slightly, with a 0.60 per cent decline, underscoring Bangladesh’s strong performance.

In volume terms, Bangladesh shipped 2.27 billion square metres of garments during January-October 2025, a rise of 15.87 per cent from 1.96 billion square metres in the same period of 2024.

By comparison, total US apparel imports during the period fell slightly to $66.62 billion from $67.02 billion a year earlier.

Sector insiders said that OTEXA data is typically published with a two-month lag, meaning the figures for September reflect shipments made in July, before the US imposed reciprocal tariffs on August 7.

State-owned Export Promotion Bureau (EPB) data, published ahead of OTEXA, indicated that overall RMG exports from Bangladesh have been trending downwards since August 2025.

Meanwhile, Vietnam emerged as the top apparel exporter to the US during the first ten months of 2025, with shipments worth $14.16 billion, up 11.54 per cent year-on-year.

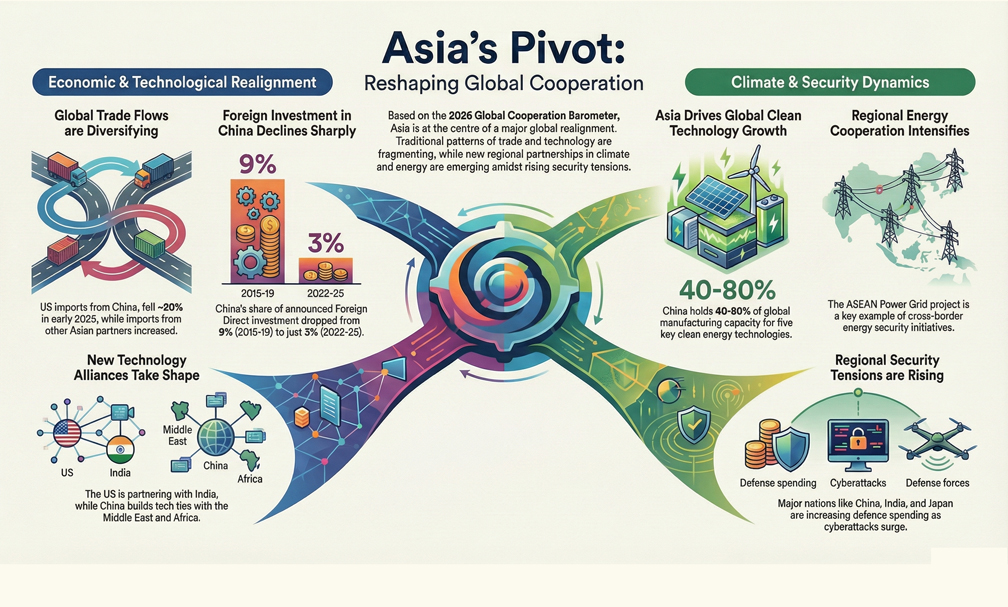

China fell to second place, exporting $9.49 billion, down 32.46 per cent, reflecting the impact of higher US tariffs and ongoing geopolitical tensions.

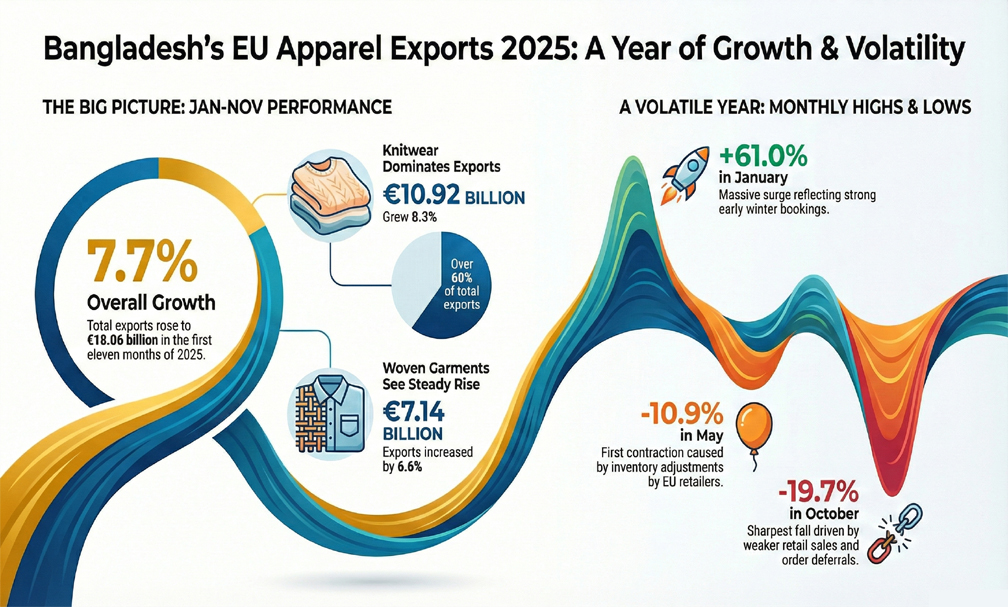

Industry experts said that while Bangladesh faces challenges in the European market, where demand has softened, Chinese exporters have been aggressively expanding in the EU by offering lower prices to offset declines in the US market.

Other notable performers in the US market included India, whose apparel exports rose 8.60 per cent to $4.39 billion; Indonesia, up 10.07 per cent to $3.98 billion; Cambodia, which grew 25.46 per cent to $4.04 billion; and Pakistan, which recorded a 12.28 per cent increase to $2.02 billion.