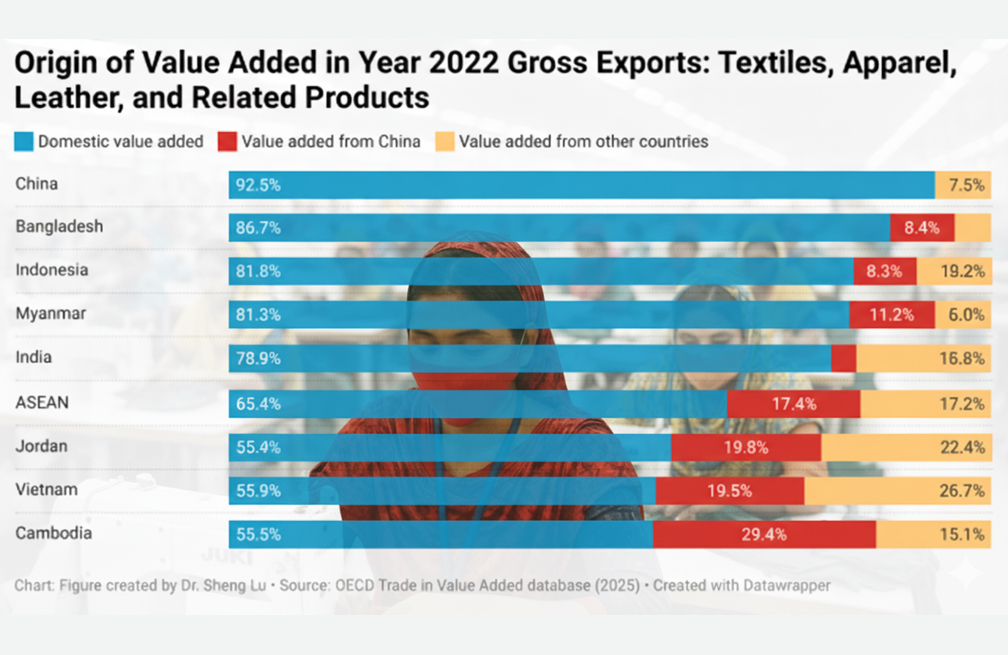

Bangladesh has emerged as one of the strongest performers in apparel and textile value addition, outpacing most Asian competitors, according to the latest 2022 data from the OECD Trade in Value Added (TiVA) database.

The analysis, conducted by Dr Sheng Lu, Professor in the Department of Fashion and Apparel Studies at the University of Delaware, provided a detailed picture of how much of each country’s textile, apparel, and leather export value is generated domestically — highlighting levels of self-reliance and import dependence within global supply chains.

According to the OECD data, Bangladesh ranked third globally in domestic value addition, with 86.7 per cent of its textile and apparel export value generated within the country — behind only China at 92.5 per cent and the United States at 88.0 per cent.

The findings suggested that most of the value in Bangladesh’s exports came from local activities such as raw material processing, manufacturing, and finishing rather than imported intermediates.

It was also indicated that only 8.4 per cent of the value in Bangladesh’s exports originated from China and 4.9 per cent from other countries, pointing to a relatively low level of dependency compared with regional peers.

The analysis showed that this performance reflected Bangladesh’s steady progress in strengthening its backward linkages over the past decade.

Between 2015 and 2022, its domestic value-added share increased from 82 per cent to 87 per cent, supported by significant investments in spinning, weaving, dyeing, and finishing facilities.

The knitwear segment was described as being almost entirely self-reliant, while the woven sector had reportedly made notable advances in local fabric production.

In contrast, the analysis found that many of Bangladesh’s regional competitors remained heavily reliant on Chinese inputs.

Cambodia’s exports derive 29.4 per cent of their value from China, reflecting limited domestic textile capacity.

Vietnam also depended on imported materials, with 19.5 per cent of its export value originating from China and 24.6 per cent from other countries.

These figures highlighted as evidence of China’s continued dominance as a supplier of yarn, fabric, and accessories across Asia’s export-oriented garment industries.

China remained the global benchmark for industrial self-sufficiency, maintaining a domestic value-added ratio of 92.5 per cent in 2022 and around 92 per cent consistently throughout 2015–2022.

This stability reflected its fully integrated textile ecosystem, encompassing fibre production, spinning, weaving, dyeing, finishing, and apparel manufacturing within its borders.

India and Indonesia exhibited moderate levels of self-reliance, with domestic value-added shares of 78.9 per cent and 81.8 per cent, respectively.

India’s share declined from 85 per cent in 2019 to 79 per cent in 2022, largely due to increased imports of synthetic fibres, machinery, and specialty fabrics.

Indonesia’s ratio was relatively stable, slipping only slightly from 84 per cent in 2015 to 82 per cent in 2022, reflecting consistent industrial capability.

Pakistan maintained one of the highest levels of self-sufficiency in the global textile sector, keeping its domestic value addition above 90 per cent from 2015 to 2022.

Several other countries experienced declines in domestic value-added shares.

Vietnam’s ratio fell from 59 per cent in 2015 to 56 per cent in 2022, highlighting ongoing dependence on imported raw materials.

Cambodia’s domestic value-added share stagnated around 56 per cent, while Turkey’s dropped from 83 per cent to 76 per cent and Jordan’s from 65 per cent to 58 per cent.

Across the ASEAN region, the average domestic value-added share decreased from 70 per cent in 2015 to 65 per cent in 2022, illustrating growing regional integration and reliance on imported intermediates, particularly from China.

In contrast, Mexico maintained stability at around 73 per cent, supported by robust regional supply chain links under the United States–Mexico–Canada Agreement (USMCA).

Outside Asia, Egypt suffered a sharp drop in domestic value addition — from 87 per cent in 2015 to 80 per cent in 2022 — as a result of greater reliance on imported raw materials and chemicals.

Myanmar’s share, which had plunged from 93 per cent to 78 per cent by 2019, partially recovered to 81 per cent in 2022 due to expansion in local processing capacity.

Overall, the OECD data indicated that between 2015 and 2022, major shifts in global supply chains, technology, and trade dependencies had significantly reshaped how much value countries generated domestically in textile, apparel, and leather exports.