Bangladesh’s plastic goods industry is witnessing steady export growth, driven by local production of raw materials, a surge in international orders, and shifting global trade dynamics.

Industry insiders said that fresh investment and capacity expansion by major groups, coupled with the United States’ recent tariff measures, would further boost the country’s shipments in the coming years.

According to the Export Promotion Bureau (EPB), Bangladesh earned $284.05 million from plastic product exports in the financial year 2024–25, compared with $244.43 million in FY2023–24.

The 16.21 per cent growth was largely attributed to a rebound in shipments of PVC bags, kitchenware, and tableware.

PVC bag exports grew by 33.46 per cent to $51.53 million, while kitchenware and tableware surged by 47.47 per cent to $43.12 million.

By contrast, exports of plastic waste fell by 15.50 per cent to $14 million. Exporters attributed the decline to a rise in local consumption within the recycling industry and weaker global demand.

Gias Uddin, a plastic waste exporter and director of the Bangladesh PET Flakes Manufacturers and Exporters’ Association (BPFMEA), said the global market has become more competitive as major buyers, including China, have shifted towards sourcing higher-grade recycled materials.

‘We export plastic waste to the US, Dubai, Vietnam, the EU, and Malaysia, while China only imports high-quality white-washed flakes,’ he said.

Shamim Ahmed, president of the Bangladesh Plastic Goods Manufacturers and Exporters Association (BPGMEA), said that work orders were rising across multiple categories, particularly household items such as kitchenware, tableware, and toys destined for Japan, the US, and the EU.

He mentioned that a large conglomerate had recently secured significant export orders and was expanding production capacity, although he declined to disclose its name.

Shamim pointed out that local manufacturing of raw materials, which were previously imported, was helping the industry remain competitive.

He said that Meghna Group had already started producing such materials, while two other groups were investing in similar ventures. Once these came into operation, he believed the industry’s price competitiveness would improve and lead times would shorten.

Shamim argued that official statistics understated the true scale of Bangladesh’s plastic exports, as a large volume of plastic accessories was supplied to export-oriented sectors under back-to-back letters of credit.

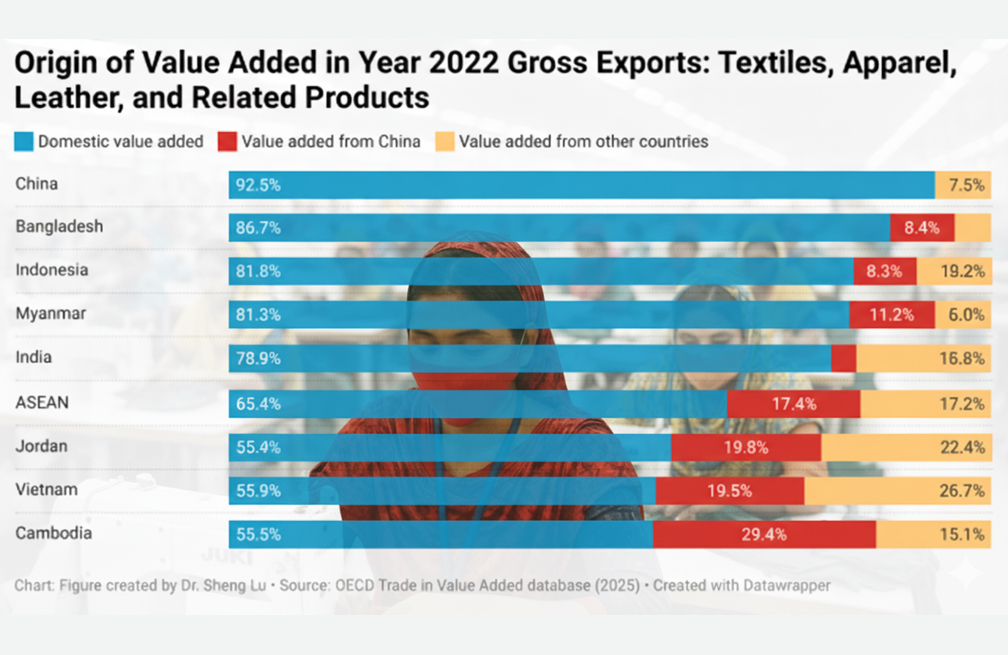

He said members of the association supplied around $1.5 billion worth of accessories to garment factories, accounting for about 3 per cent of their input needs.

He claimed that these were effectively exports, criticising EPB’s data as statistical disinformation.

Shahedul Islam Helal, managing director of Bengal Pacific, echoed this view. He said that his factory supplied polybags, hangers, and gum tapes to the apparel sector and that orders were increasing as buyers preferred compliant factories, particularly those linked with the readymade garment industry.

He said that accessories should be fully included in export statistics to better reflect industry performance.

Despite recent gains, challenges remained. Bangladesh had yet to capture a meaningful share of the global toy market, even though it enjoyed duty-free access and competitive labour costs.

Industry insiders observed that China’s shift towards high-tech industries had created an opening.

However, Shamim pointed out that the sector was still heavily dependent on imported moulds—mainly from China—and on costly certification processes in India and Singapore.

Industry representatives called for government support to foster domestic mould manufacturing, improve financing facilities, and ease certification processes.

With the right policy framework, they believe Bangladesh could significantly expand its footprint in the global plastic goods market.